Straight Talk: Financial Insights

Personal Finances Blog

When you submit to have your credit checked for a mortgage loan your information may be sold by credit bureaus to other lenders. Those lenders will then reach out with unsolicited mail, phone calls, and emails with offers. These are referred to as "trigger leads". The good news is you have the ability to opt-out before they even begin.

How do trigger leads work?

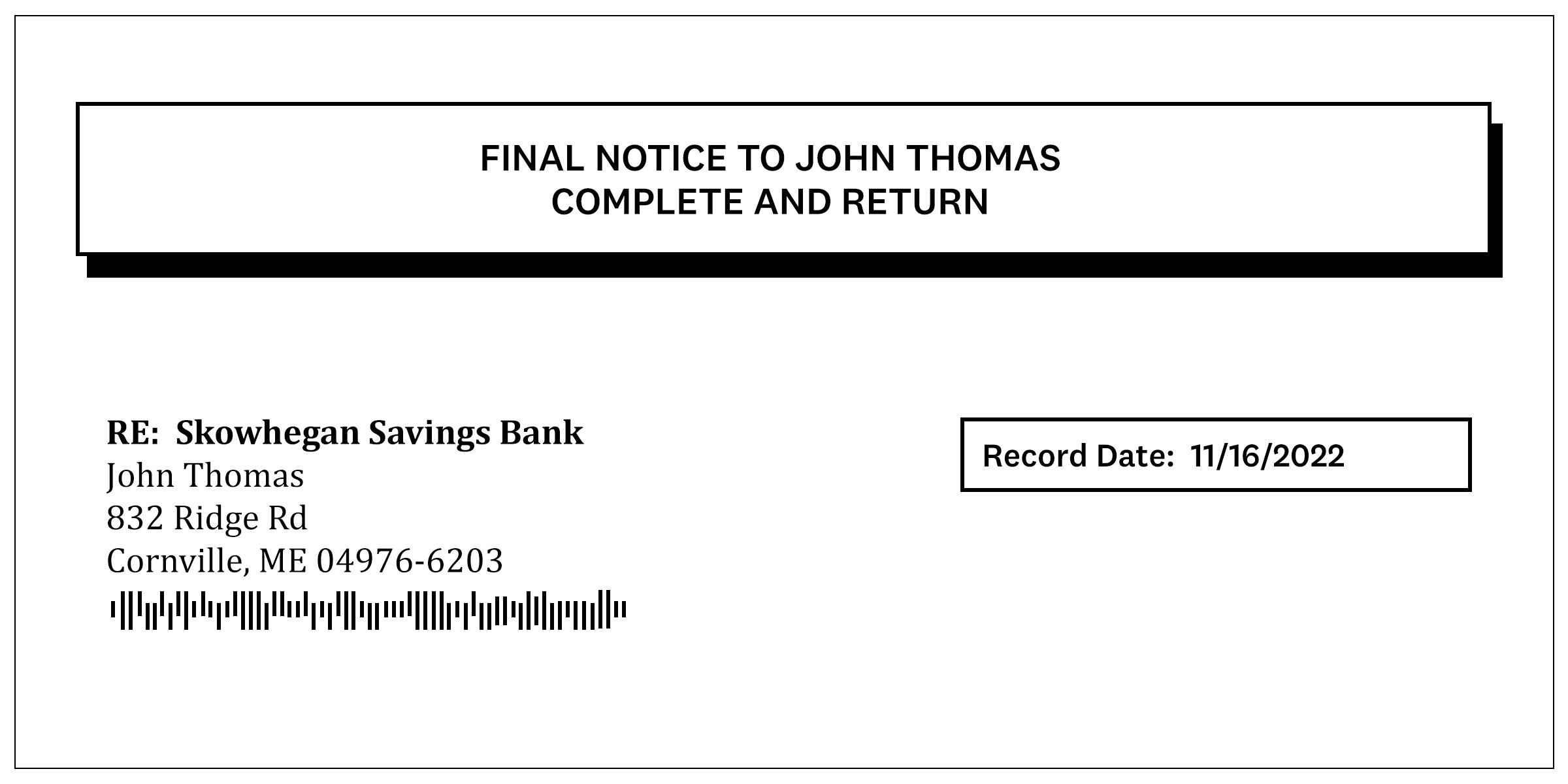

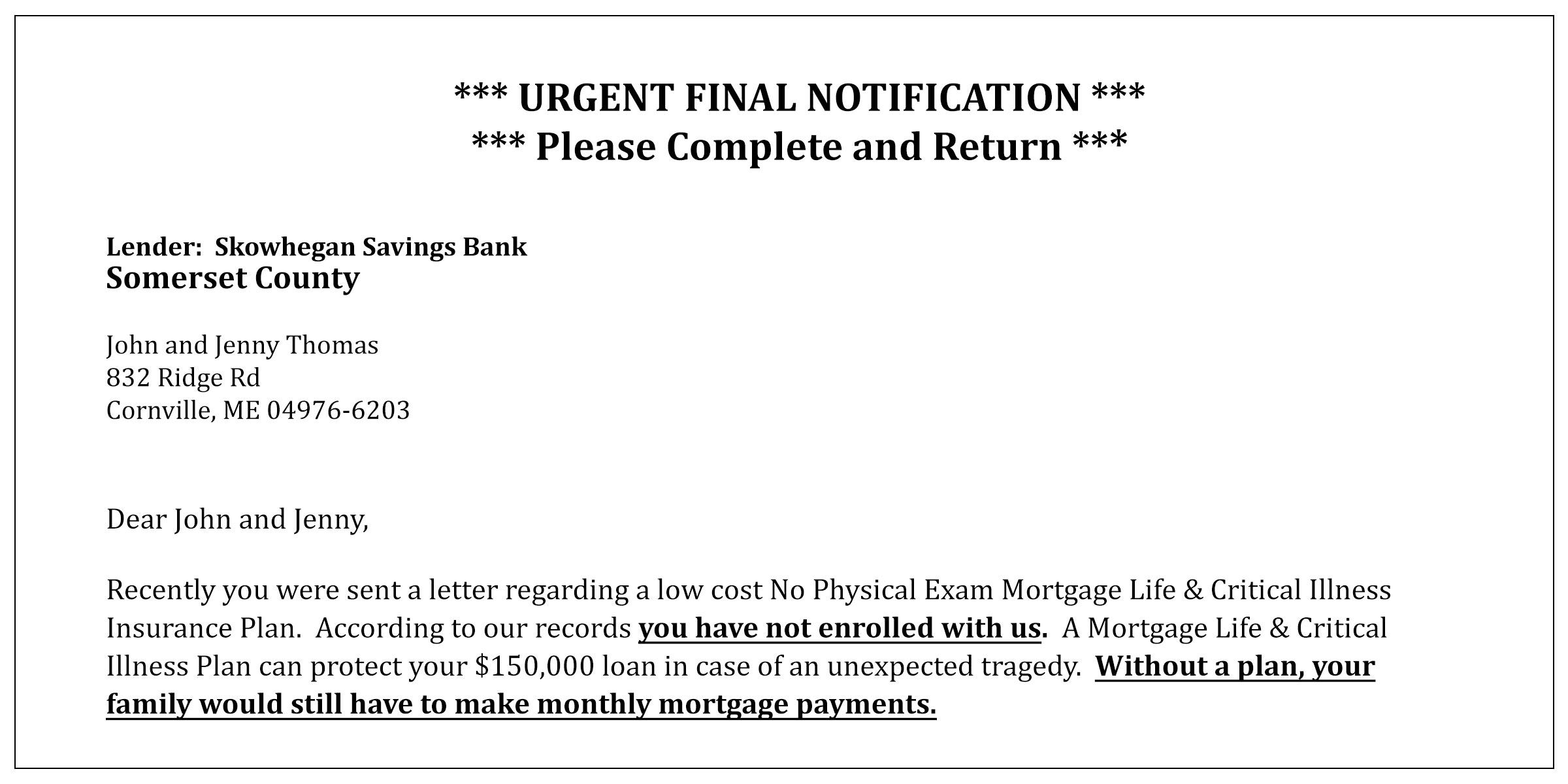

It's important to note that Skowhegan Savings does not sell your information. When the borrower's credit report is run for a mortgage application, credit bureaus can sell the applicant's name and contact information. This is referred to as an "event-based trigger" that identifies the borrower as shopping for a mortgage or to refinance. When third-party vendors and competing mortgage companies acquire your information, they promptly start soliciting you to win your business. Often, applicants will receive "Urgent Final Notification" letters through the mail similar to the examples below. The companies that purchase "trigger leads" tend to be unethical and aggressive, even though the practice is legal under the Fair Credit Reporting Act.

|

|

How to opt out of becoming a trigger lead

To opt out of prescreened credit and insurance offers go to optoutprescreen.com or call 1-888-5-OPT-OUT (1-888-567-8688). The major credit bureaus operate the phone number and website. Doing this will opt you out for 5 years. If you want to opt out permanently you will need to sign and return the Permanent Opt-Out Election form that you will get online.

To reduce or completely eliminate unsolicited contact through trigger leads or pre-screened offers you can call the National Do Not Call Registry to stop unwanted phone calls. Just visit donotcall.gov or call 1-888-382-1222 (TTY: 1-866-290-4236) from the phone you want to register. After you register you will receive an email with a link that you need to click to complete the registration. It will take 31 days to become effective.

If you need any further information, contact Skowhegan Savings community bankers who are always ready to help!